The Demographic Context for Asset Sales by Baby Boomers

My practice, and the practices of most colleagues and friends who are also trust and estate attorneys, has become busier than any of us ever expected after the 2010 tax act made high estate tax exemptions an (allegedly) permanent part of the landscape. I think one issue, more than any other, has been the key driver of how busy we all are: demography.

Boomers are avalanching into retirement – a time when it’s natural to revisit estate plans. Because it is such a large cohort, even with welcome increases in life expectancy, estate administration activity seems to be increasing too.

The demographic context facing any particular Boomer household will be influenced by the size of their cohort, and what the Boomer cohort wants to do with its balance sheet will, in turn, have large collateral effects on the generations downstream.

Consider three key balance sheet elements: equities, residential real estate, and closely held businesses.

If you consume investment commentary, the idea that the Boomers accreting retirement assets was positive for equity valuations in the 90s and early 2000s, isn’t a new one – nor is the concern that required minimum distribution outflows from Boomer retirement plans will be a headwind against future stock price appreciation. Many commentators called the Boomers-sell-stock issue far in advance.

The buyers in the emerging overseas middle class who are positioned as the solution to the Boomer stock sale wave, however, aren’t as likely to buy your residential real estate or closely held business (although Chinese or Russian oligarchs may want your commercial real estate…). Those asset classes are captive to this region’s trends in population, wealth creation, and economic vitality (spoiler alert: this is not necessarily an advantage).

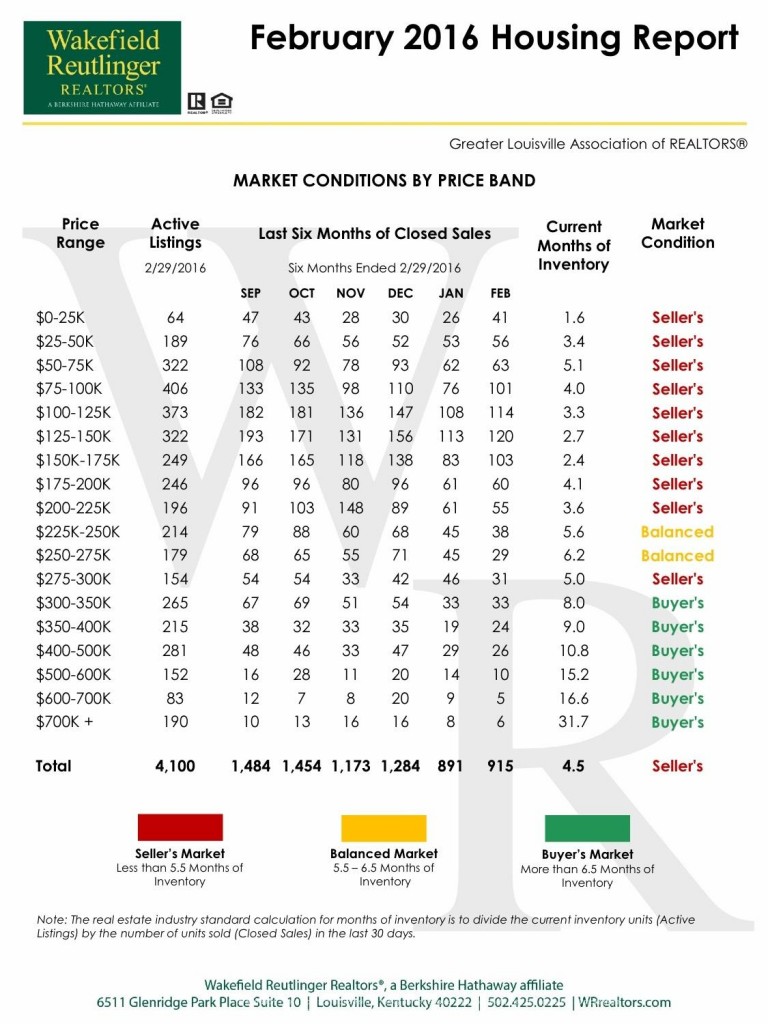

I believe we may be seeing Boomer demography at work in the Louisville residential real estate market.

Just this week, a friend shared a LinkedIn post with data from the Louisville Association of Realtors about the local housing market.  Affordable real estate is in comparatively shorter supply, but the higher up the price range you go, the greater the supply and the more adverse the landscape for sellers.

Affordable real estate is in comparatively shorter supply, but the higher up the price range you go, the greater the supply and the more adverse the landscape for sellers.

Who tends to own (but want to downsize) larger, more valuable houses? Boomers.

Who has the appetite and capability to buy those homes (and then spend a seemingly near-infinite amount of money further renovating their kitchens)? Gen-X mid-career professionals.

There are 118 Boomers for every 100 Gen-Xers. One can’t help but think that demography is driving a lot of what’s happening here.

I think it’s a similar story with closely held business owners. The Boomer cohort has tended to have fewer children than they had siblings. Further, the last 30 years in Louisville and similar “flyover” cities have seen many business owners’ children migrate to the coasts seeking a more vibrant opportunity set.

All other things equal, these trends reduce the pool of potential next-generation family business inheritors. Boomers are no different than earlier cohorts of business owners in that a business sale is often an express (or, very often, implied) part of the owner’s retirement plans.

The size of the Boomer retirement wave (and the shrinking pool of children available to continue running these businesses to generate retirement cash flow for their Boomer parents) leads to a situation where the pool of sellers is larger relative to the pool of buyers than it was a generation ago.

A sale to a private equity buyer can be an alternative if your business is large enough to attract interest, but if your business is too small, features a lot of goodwill, or can’t be profitably leveraged, streamlined, and re-sold in a relatively short 3 to 7-year time frame, the private equity market may not be interested.

You don’t need to have read very much by Adam Smith to intuit that this situation isn’t favorable for strong pricing and quick sales of closely held businesses.

What’s a Boomer to do? How can they sidestep the collateral effects of just how large their selling cohort is compared to the cohort of buyers behind it? Some suggestions are relatively obvious, but still bear repeating:

- Sell the big house or the family business uncomfortably early. Boomers born in 1951 are turning 65 this year, and the Boomer cohort grew year-on-year every year through 1959, which means the supply-demand equilibrium for Boomer asset sales will get worse every year through 2024.The natural human tendency to procrastinate about making difficult decisions means that the comparative advantages of acting even two or three years before others could be quite large, given the demographics in play in the next decade.

- Consider a gift/sale of a family residence. If you can’t sell your house for what you think it’s worth, then shouldn’t your child get a good deal, rather than a stranger? If you have an out-of-town child who won’t get the benefit of the gift/sale, you can update your estate plan to provide an equalizing bequest in favor of the out-of-town child.

- Now, more than ever, build retirement plans with non-business, non-residential assets. Even when the demographic tailwind is favorable, plans that rely on selling an asset for “Price X” at “Time Y” are vulnerable to recession and/or a liquidity crunch. These plans weren’t ever robust, and now, in this demographic context, they really aren’t.

- Cultivate connections with younger people. I’m often surprised and amused about how much “pre-sale” word-of-mouth activity occurs in the high-end residential real estate market.Now, more than ever, the 43-year old Director at the Fortune 500 company that just moved to town (or that mythic creature, the young radiologist who moved here after the residency in Cleveland) is critical if you’re going to sell your “$800,000 house” for the price you want, on the time frame you want.If your civic, business, community, or charitable activities offer opportunities to meet people a generation behind you, take advantage of them!

Similarly, if you’re a business owner, cultivate younger professionals who might be looking for an exit from corporate America (before they themselves are “exited”). Get to know middle-market M&A advisors and business brokers. Start planning for a sale or transition at least three to five years before your intended retirement date.

None of us can change the demographic context in which we conduct business, plan for retirement, and pay taxes.

But until more clients and their advisors give demography the importance it deserves as a planning variable, there will be opportunities for those who do to comparatively outperform. Be one of those people!