What Is the Funding Status of Your Personal Pension?

Pause and reflect on what a pension is: income for life after you retire, intended to replace part of all of your employment income.

Pause and reflect on what a pension is: income for life after you retire, intended to replace part of all of your employment income.

For retirees in the “Greatest Generation,” pensions were common. For a host of reasons (presented well by Jacob Hacker in his 2006 book The Great Risk Shift) structural changes in the American economy since 1980 have driven traditional defined benefit pensions almost extinct for private sector workers.

Instead, during your years in the workforce, you must build your own “Personal Pension.”

Your Personal Pension payment for each and every year of your retirement is a promise you’re making to yourself, and you want those promises to be fully funded. How much will that cost?

There are several issues to keep in mind as you consider Personal Pension funding levels: longevity, target annual income, and projected investment returns.

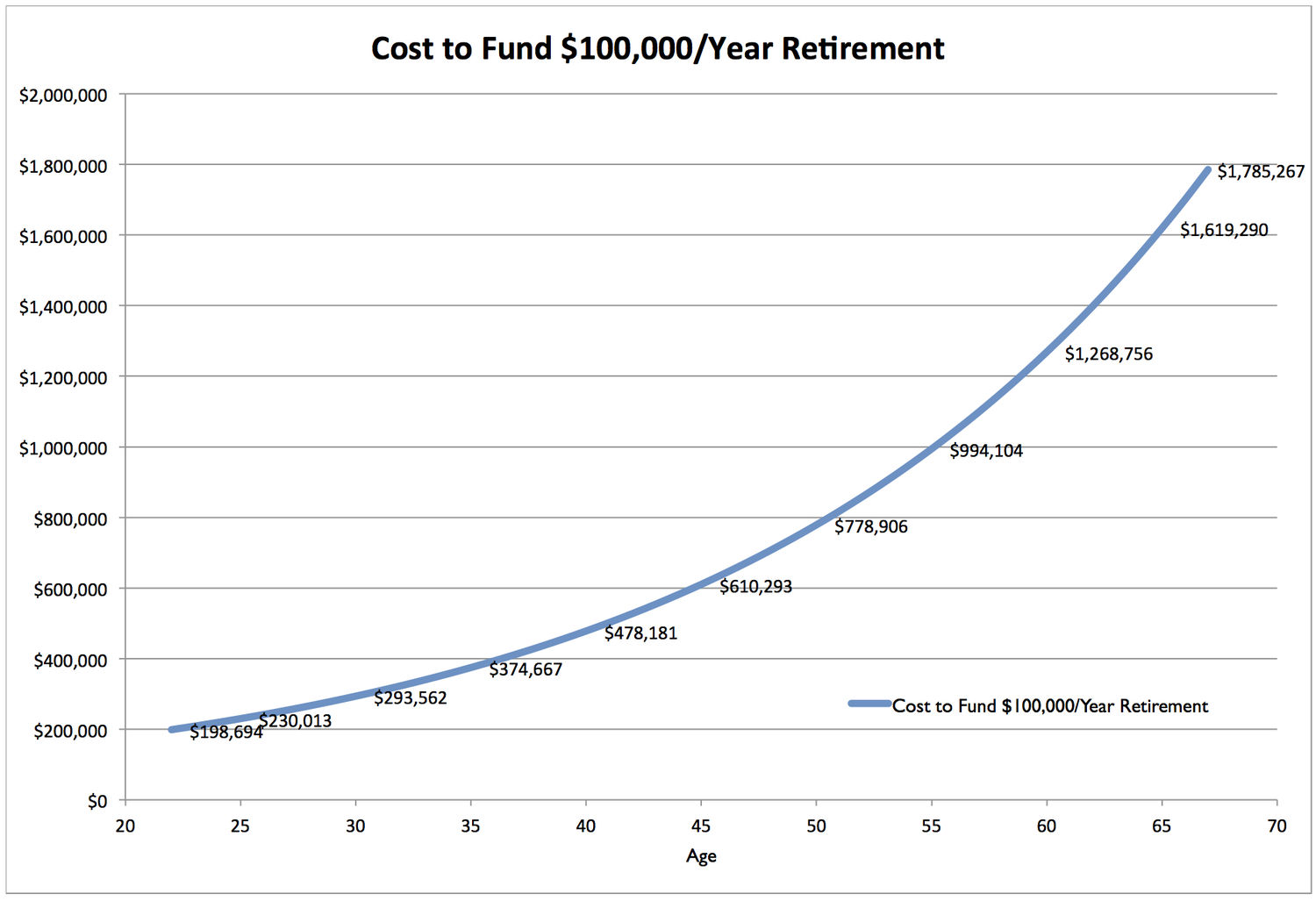

I built a model to exp lore these issues, and the results are summarized in the chart below.

lore these issues, and the results are summarized in the chart below.

The Personal Pension model is cautious about life expectancy, and assumes retirement will last until age 100. In reality, according to the Social Security Administration, 50-year-old males have a 99% chance of not living past 100 (for 50-year-old females, it’s a 97% chance).

Projected investment returns will vary over time, but at present, a 5.2% real return for global equities seems at least directionally reasonable, given current dividend yields, TIPS yields, and global growth forecasts.

The model assumes exposure to global equities through a low-cost index fund in a tax-deferred retirement account for 0.2% per year, reducing net real returns to 5.0%. (As previously discussed, your retirement will be shorter for any given target funding level – or you will have to save more – if your investment costs are higher, or you fail to manage your behavioral tendencies.)

It’s your Personal Pension, so you have to decide on your own target annual income. (This example supposes you’re aiming for an inflation-adjusted $100,000 per year.) If you want a larger or smaller Personal Pension, adjust the required funding levels at each age proportionally.

For corporate finance types, the model’s math is really easy, but there may be the occasional classics major reading this, so bear with me.

The net present value of the liability represented by each year of your retirement is:

Target Income / ((1 + Projected Net Real Return)^(Your Age in Retirement Year – Your Current Age)

Let’s make the math less abstract by showing two different years of retirement for the same 50-year-old person who retires at age 67.

1. Funding their last year of retirement from age 99 to age 100 with $100,000 of income is a liability with the present value:

$100,000 / ((1.05)^(99-50)), or $9,156.

2. Funding their first year of retirement from age 67 to 68 with the same $100,000 annual income is a liability with a much higher price tag, because it has to be funded much sooner.

$100,000 / ((1.05^(67-50)), or $43,630.

As the chart above does, it’s easy to sum the net present value of the liability for funding each Personal Pension payment, and determine your retirement funding liability at any particular age before retirement.

Then, by comparing that funding requirement to your current level of retirement savings, you can determine the extent your retirement is underfunded (or, a better problem to have, the extent it’s overfunded).

For instance, if our 50-year-old test subject has retirement assets of about $780,000, he’s on track. Assets above level might suggest early retirement was feasible, while assets below that level suggest increased savings are advisable.

By thinking about retirement saving as funding your Personal Pension, we see some familiar financial planning issues in new ways:

- Early retirement is expensive, because you’re adding years to the front of your retirement period, not the back. The net present value of the liability for funding an extra year for your Personal Pension in your 60s will naturally be larger than an extra year in your 90s.

- At age 22, the liability to pay yourself an annual $100,000 Personal Pension starting at age 67 has a net present value of a little under $200,000. Very few workers enter the workforce with that kind of balance sheet, so in their 20s and 30s they try to “catch up” to target funding levels.

- The size of the Personal Pension liability grows each year by the projected net investment returns of 5.0%. The sooner one creates a pool of retirement savings, the more each year’s Personal Pension funding requirements will be met through investment returns, reducing the need for annual savings from current income.

- De-risking assets that fund your Personal Pension will reduce future returns, increasing the required amount. In this area, as in so many others, seeking security may be a good decision, but it comes at a price. (I’ll explore this issue in future posts.)

- A family that could send a child to an expensive (e.g., private) college, but instead sends them to a lower cost option like an in-state public university and invests the difference for their child could “launch” their child into the workforce with a substantially (or even entirely) funded Personal Pension right out of the gate.

- By age 67, $17.85 of assets is needed to fund $1 of annual retirement income through age 100. That’s a lot, but it’s less than the traditional $25 of assets per $1 of income suggested by the “4% Rule” for safe withdrawal rates.

In my experience, most retirement funding calculators are scary, because they always tell you you’re behind. It’s daunting to try to save towards a single “ginormous” number: realizing that you are funding your Personal Pension one year at a time makes the project feel far more manageable.

Conventional wisdom regarding the “4% Rule” for safe withdrawal rates is also demoralizing, because it casts retirement as a project requiring your own Personal Endowment that will last in perpetuity, as if you were a small version of Harvard.

I hope it is not news to you that you will not last in perpetuity. For your retirement funding project, that’s good news, because a Personal Pension requires less funding than a Personal Endowment.

Financing retirement is challenging.

By seeing the project for what it is – funding your Personal Pension – you avoid making it harder than it needs to be.