Protecting Your Personal Pension From Volatile Equity Markets

Our previous post explored a model of the cost of the promise you make to yourself to fund your retirement, but that model omitted a very important real-world risk: volatile equity markets.

Our previous post explored a model of the cost of the promise you make to yourself to fund your retirement, but that model omitted a very important real-world risk: volatile equity markets.

Most recently, the 2008 stock market crash changed many retirement plans for the worse. A 2009 study by the Urban Institute, “What the 2008 Stock Market Crash Means for Retirement Security,” provided a quantitative forecast of the crash’s effects. When the study was published in 2009, it included three scenarios for the stock market: no recovery, a partial recovery, and a full recovery.

With the benefit of six years’ hindsight, we see (happily) that the full recovery scenario they modeled is the one most closely describing the retirement effects of the 2008 crash.

The Urban Institute study quantifies some important (and perhaps obvious) insights:

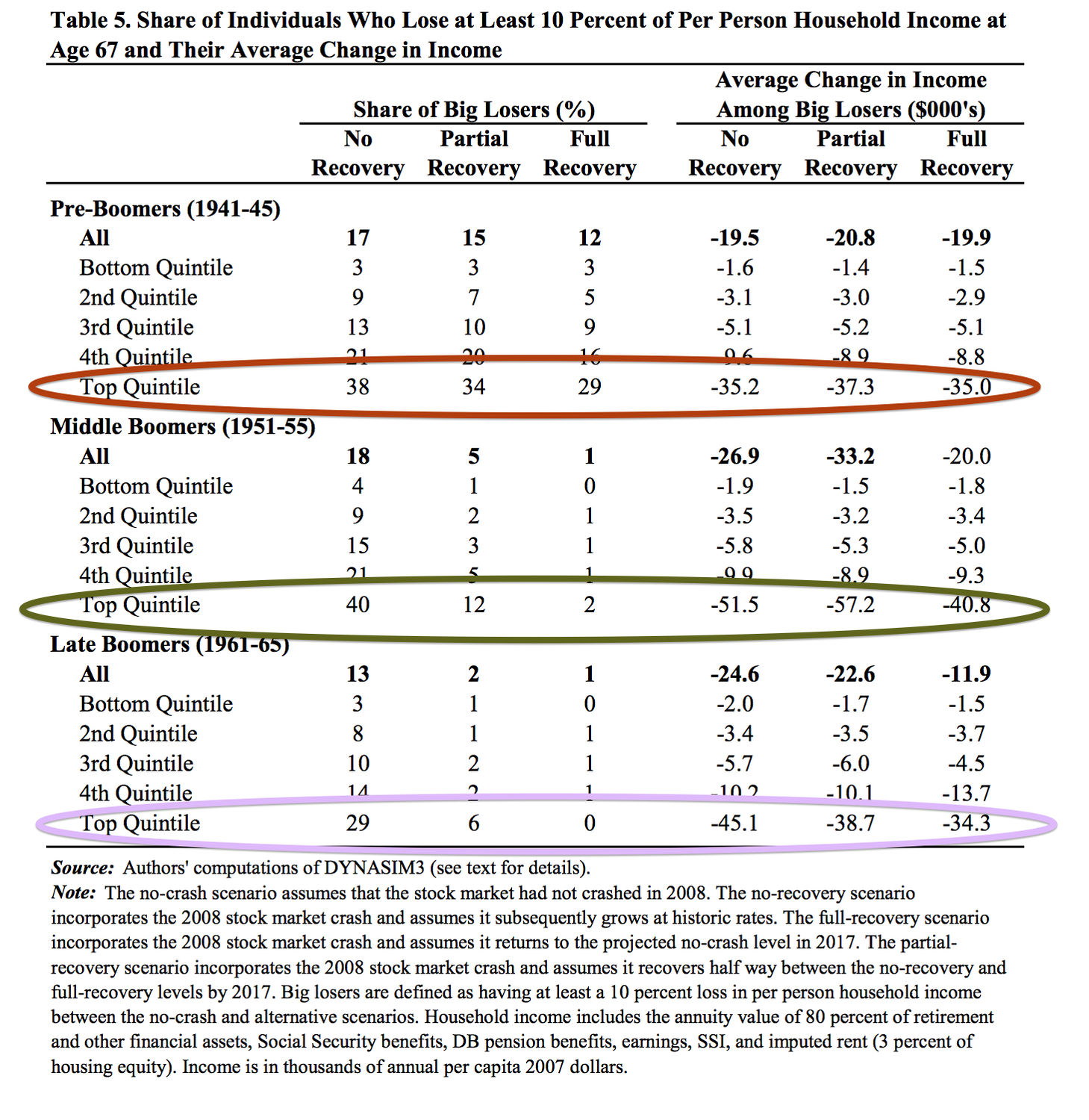

Higher earners are more exposed to stock market volatility, because they save more, and more of their savings tend to be allocated to equities.

For instance, Table 5 from the study, below, shows that earners in the top 20% of income born between 1941 and 1945 were about ten times more likely to have a 10% reduction in retirement income from the crash than earners in the bottom 20% of income.

If a person has a short time left in the workforce and the stock market crashes, and the person is heavily invested in stocks, that person’s standard of living in retirement can be permanently impaired.

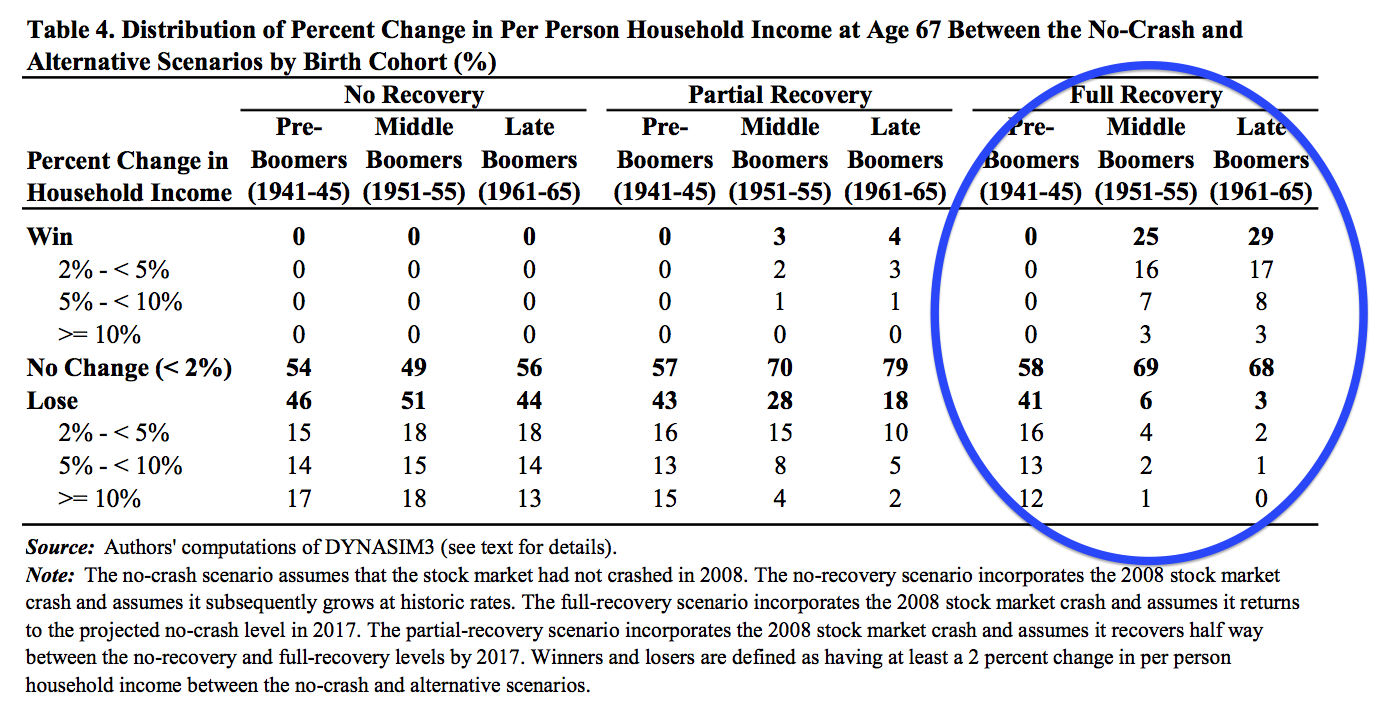

Table 4 from the study, below, shows that “pre-boomers” (between age 63 and 67 at the time of the 2008 crash) were about 7 times more likely to suffer income reduction from the crash than “middle boomers” (between age 52 and 57 at the crash), who had more time to recover.

If a recovery from a crash happens, the crash can create winners and losers, as those with income and time in the workforce after the crash have an opportunity to buy equities at lower prices.

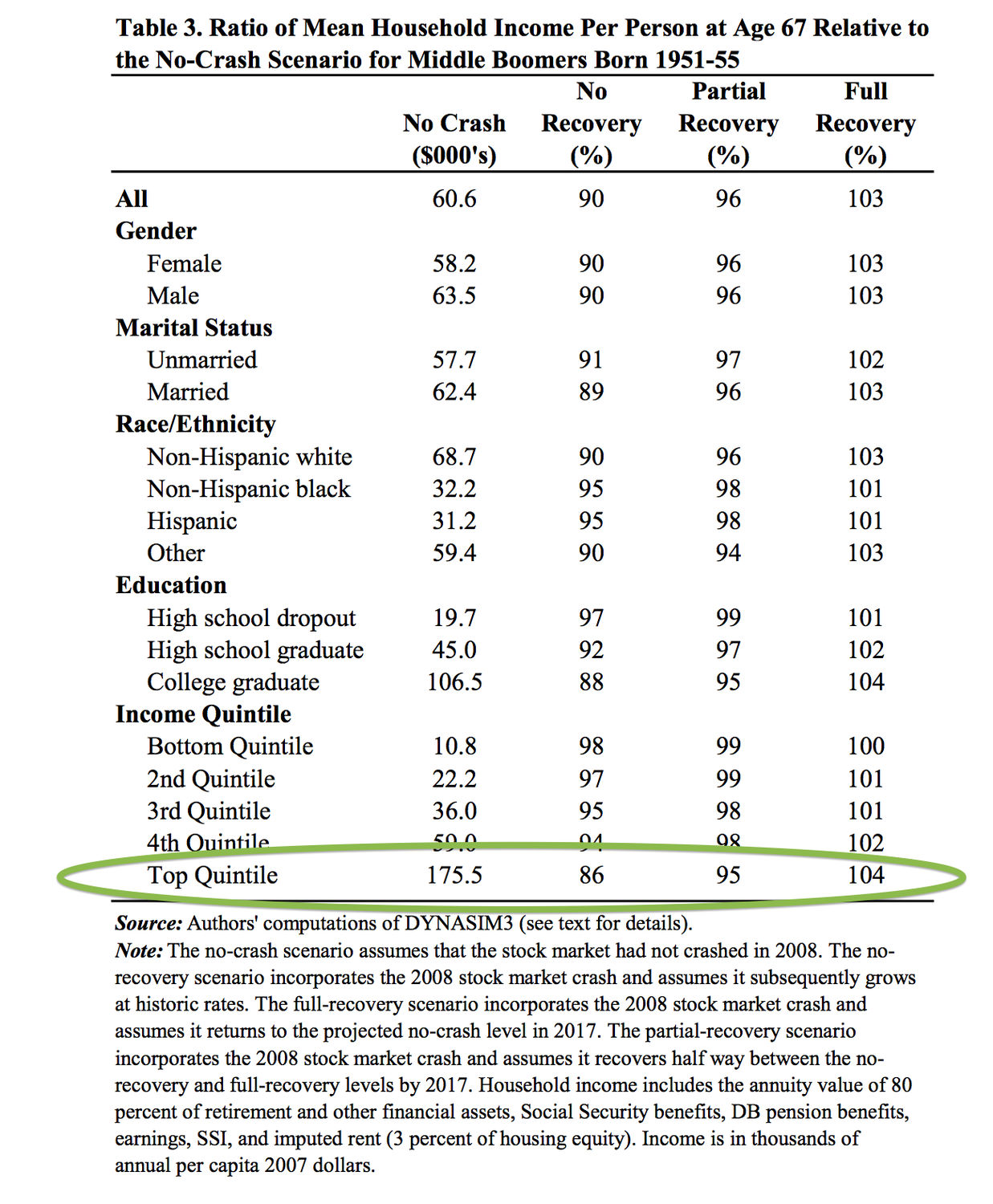

Table 3, below, shows that for the top 20% of earners, a crash without a recovery can reduce retirement income by 14%, while a crash with a full recovery can actually increase income by 4%.

To increase protection for your Personal Pension from a stock market crash happening at a particularly inconvenient time, you can methodically reduce the degree to which a particular year’s Personal Pension payment is exposed to equity market risk as you draw closer to the year those funds will be spent.

This concept of a “glide path” on which equity exposure is reduced and fixed income exposure is increased on a set schedule before funds are needed is widely used for target-date retirement funds and “goals-based” wealth managers.

By “peeling off” a Personal Pension payment from your “risk” portfolio fifteen years (for instance) before you’ll need it, and transitioning those funds through a glide path that moves steadily into a higher allocation to fixed income, you can insulate your Personal Pension from the risk of retiring on the verge of a stock market crash, and selling equities to fund lifestyle needs when they’re at low valuations.

This approach can enhance your peace of mind, but like any insurance against risk, it carries a price.

In this instance, the price is the opportunity cost of what you won’t earn on Personal Pension payments moving through your stocks-to-bonds glide path. The specific opportunity cost will depend on the difference between equity and fixed income returns during the time assets are in the glide path rather than the risk portfolio, and the way the glide path is designed.

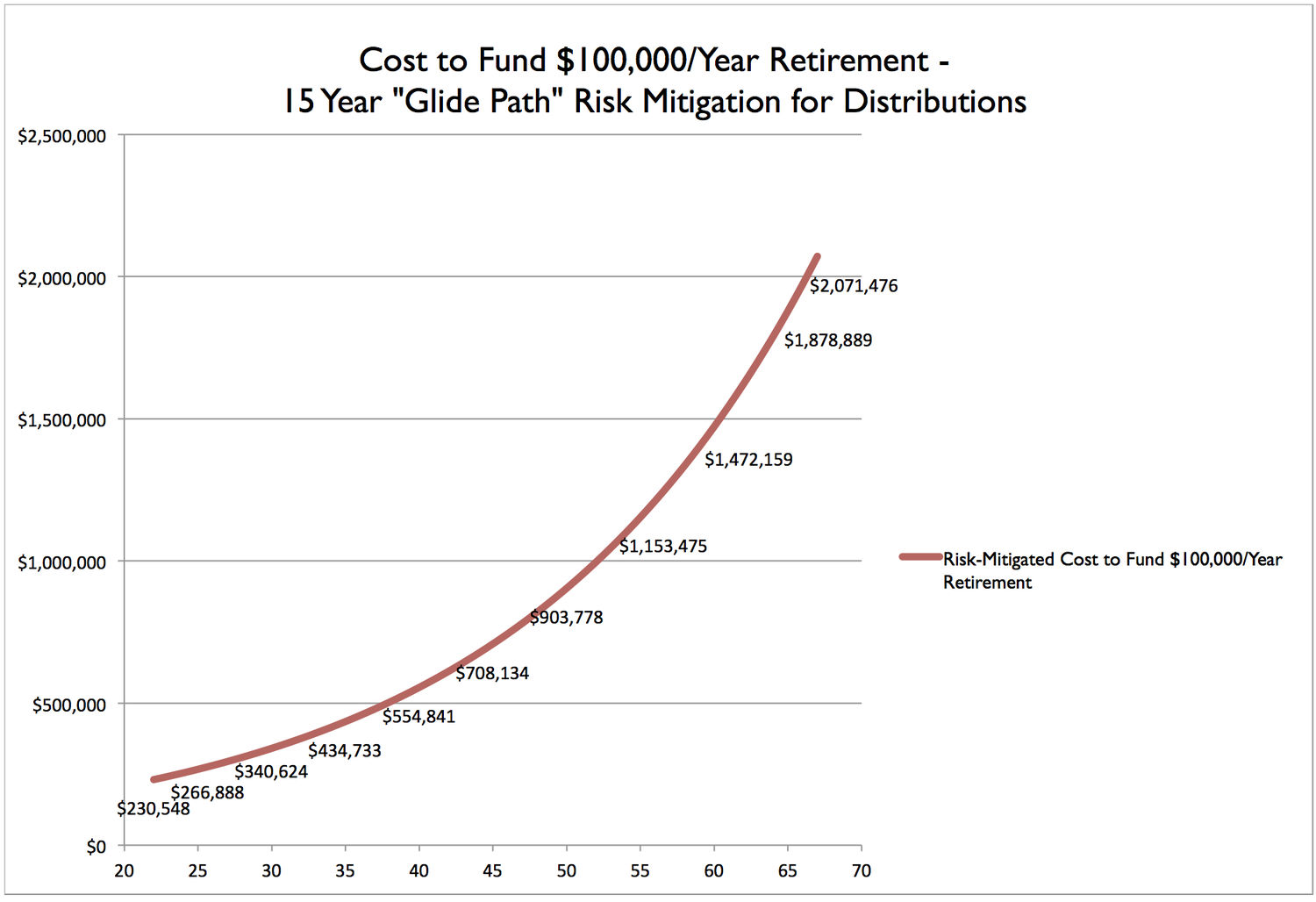

I made a revised model to explore the funding cost for a Personal Pension that provides an element of protection against poor equity market returns in the years shortly before payments come due. The results are summarized in the chart below.

The model uses the trailing 12-month return on an ETF tracking the Barclays Aggregate Bond Index, a proxy for the US investment grade bond market, net of the ETF’s investment management costs. Other assumptions remain as discussed.

This revised model shows that funding a personal pension that’s comparatively insulated against stock market declines in the years before funds are needed costs about 15% more than a pension without similar risk mitigation.

The model’s results are (naturally) scalable up or down, so you can adjust your Personal Pension funding requirement up or down to match your anticipated “burn rate” in retirement (based on your own Total Income Statement) and do a quick check on whether your retirement asset building is on track at your particular age. (Bear in mind that the model inputs should be updated as needed to reflect changes in interest rates and dividend yields.

So, there you have it: by age 67, under current conditions, each dollar per year of Personal Pension income (provided with a fair measure of protection against stock market crashes) will require approximately $21 to fund.

With the ability to gauge progress along the way and to calibrate spending to match available resources, funding your Personal Pension will be challenging — but likely not impossible.

Photo credit: “Hurricane Damage at the Seacrest Hotel, Delray Beach, Florida” State Archives of Florida, Florida Memory, http://floridamemory.com/items/show/38352