Why Life Cycle Planning?

More than a decade of work with clients in private law practice and at a trust company has convinced me that estate and financial planning produces higher quality and more useful results when it’s done in an integrated way, grounded in the life cycles of clients and their families.

Because I think this integrated approach is really important, I’m working intensively on a publishing project focused on it.

Bibliography

You can click the link above for an extensive and growing reading list of books, articles, research studies, and white papers that relate to the quantitative, qualitative, and cultural aspects of integrated life cycle estate and financial planning.

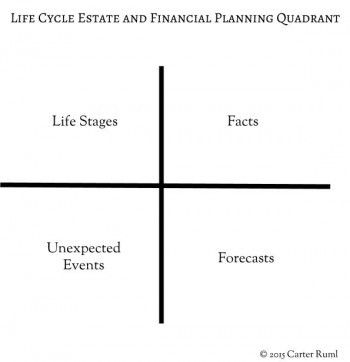

Life Cycle Planning Mind Maps, Figures, and Tables

As part of the publishing project, I create tools other planners or clients may find useful, and are welcome to use (please provide appropriate attribution, and your feedback is invited). Some of these are linked below.

Life Cycle Planning Total Balance Sheet

Life Cycle Planning Total Income Statement

Delayed Retirement Effects of Investment Costs and Behavioral Tendencies

Archive of Articles on Life Cycle Planning

All of the site’s articles on trusts, estates, and financial planning with material elements of life cycle planning are available here.