What Is Your Investor Personality Profile?

Successful investing presents practical and emotional difficulties. Reducing those difficulties as much as possible turns on your answers to two questions:

Do you believe markets are efficient?

Can you manage your behavioral tendencies?

After you have thoughtful answers to those two questions, it’s easier to make good decisions for you about choosing an investment style and the type of advisor you’ll work with best (if any).

The first key question is what you think about market efficiency.

The “markets are efficient” argument has been made well by many academics (notably Burton Malkiel at Princeton in his A Random Walk Down Wall Street). Generally speaking, proponents of market efficiency are very skeptical that market timing is feasible, and that beating the market on average over long periods of time is possible. They focus on obtaining access to long-term market performance as cheaply as possible, often through low-cost index funds.

Proponents of the “markets are not efficient” argument point to events like the 1987 U.S. stock market crash (down 25% in one day) and the more recent “flash crash” in 2010. They believe security selection done right can permit market-beating returns over time, and point to individuals like Warren Buffett and Seth Klarman as examples.

Still other market participants seem to take a hybrid approach that markets may be efficient in many ways over long time periods, but present near to mid-term inefficiencies that can be exploited for advantage. John Hussman and other tactical asset allocation funds are example of the hybrid approach, which focuses a lot of energy on trying to call the tops of bubbles early, and finding the right time to reenter markets after a downturn. As shown by experiences in recent memory from 2007 through 2011, rewards to making these calls correctly are very large, but the costs (including opportunity costs) of being wrong are also quite high.

The second key question is whether you can manage your own behavioral tendencies.

Can you ignore your investments for months at a time? Do you trade frequently? What motivates your trading? Greed? Fear? A bit of both? Can you avoid the demonstrated tendency of individual investors to chase performance – buying high and selling low? (Many studies show that individual investors’ actual returns substantially underperform market averages.)

It’s hard to answer this question accurately if you’re a new investor, but it becomes easier as experience accumulates (especially hard knocks).

Unless you are a very young or new investor, your actual behavior during the 2008 financial crisis and related stock market crash provides an excellent “rough” answer to how much you can manage your behavioral tendencies.

If you sold quickly and are still out of the market, or reentered it only in 2013, you are extremely behavioral. If you sold later and reentered quickly, you are somewhat behavioral.

If you didn’t sell, but didn’t buy after the crash, you’re behaviorally neutral (or, alternatively, oblivious to current events).

If you didn’t sell, and actually bought as much as possible instead, you have ice water in your veins and are completely non-behavioral. You’re likely very wealthy (congratulations).

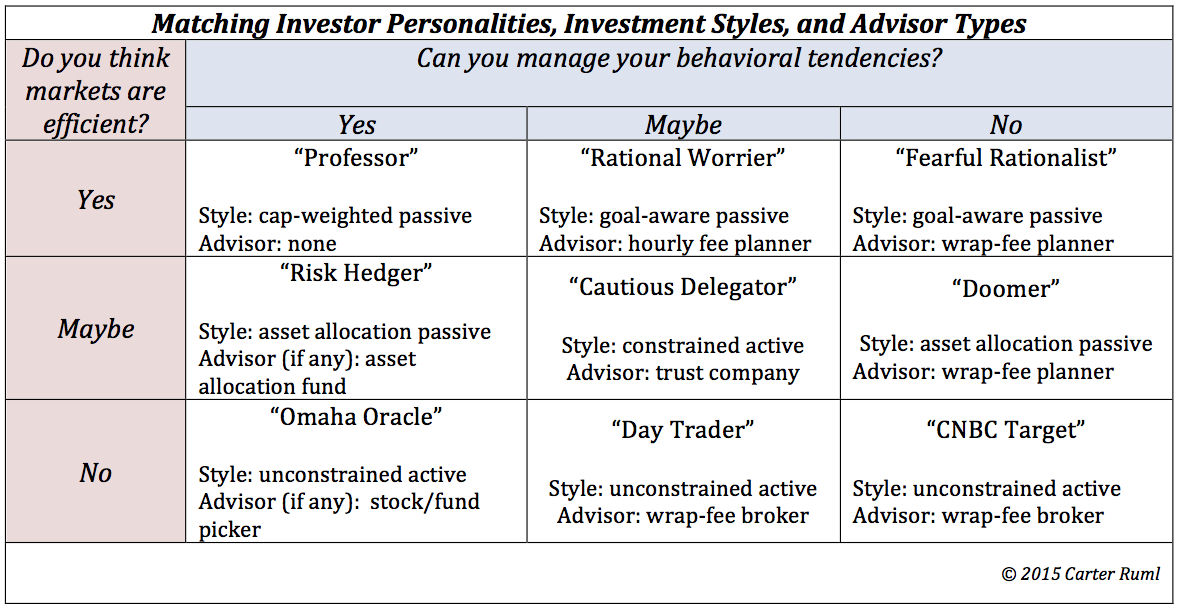

Although the real world is much more subtle it’s useful to consider which of the nine “Investor Personalities” resulting from the two questions (each with three answers) most closely fits you.

Professors believe markets are efficient, so they’re skeptical that advisors can beat the market, and they don’t need to work with an advisor to manage their own behavioral tendencies.

On the plus side, because Professors are a good fit for low-cost providers of index funds like Vanguard, they can benefit from cost savings opportunities. On the down side, Professors face risk when specific goals like funding college tuition or retirement coincide with several bad years in the markets. Professors’ approach is logical and performs best for institutions, and/or over very long time frames. Because at most levels of wealth, a family’s finances differ greatly from those of a university endowment, sometimes the Professors’ approach may be incomplete.

Rational Worriers believe markets are efficient in their heads, but their hearts often fear otherwise.

Because they’re skeptical that advisors can beat the market, Rational Worriers might invest using use low-cost index funds. Over time, however, they’ll manage behavioral tendencies better by working with an advisor who can provide feedback and ideas about matching those passive investments to particular financial goals. This feedback can be reassuring before and during market downturns, and be a useful prompt for rebalancing and other risk control measures during bull markets.

For a Rational Worrier, a financial planner charging an hourly rather than asset-based fee might be the right fit.

Fearful Rationalists want to believe that markets are efficient, but left to their own devices, have a very hard time preventing their behavioral tendencies from derailing a passive investment approach.

To minimize damage from inept market timing, it’s important for a Fearful Rationalist to work with an advisor that they trust, who is willing to spend time listening to them carefully.

With the right advisor, the Fearful Rationalist will be distanced from his or her portfolio’s “sell button”, keeping them in the market more consistently and boosting actual long-run returns compared to trying to go it alone without an advisor.

A comparatively low cost financial planner with a passive investment approach who charges an asset-based “wrap” fee might be the right fit for the Fearful Rationalist.

Risk Hedgers find market efficiency theories logical and appealing, and want to lower investment costs. On the other hand, they have trouble reconciling theory with outlying observations in their data set, including the 1987 crash, the Flash Crash, and bubbles.

Risk Hedgers are suspicious about the ability of security selection to deliver long-term outperformance, but seek risk control through asset allocation. Risk Hedgers tend to use passive tools like index funds for exposure within each asset class, but have to make difficult decisions about allocations among asset classes (particularly bonds, equities, and cash).

Because they tend not to think security selection adds excess return, and effectively manage their own behavioral tendencies, Risk Hedgers tend not to work with advisors (although they might choose among strategic asset allocation funds).

On the positive side, Risk Hedgers tend to have lower “top line” investment costs, as well as the opportunity to benefit from good asset allocation decisions. On the negative side, they are exposed to substantial opportunity costs from incorrect risk control decisions.

Cautious Delegators think markets are efficient in some ways, some of the time, and can manage their behavioral tendencies in part, but not consistently.

For the Cautious Delegator, an index-constrained investment style delivered by a trust company can be a good fit. The index-constrained strategy maintains industry weights similar to benchmark indices, but selects only stocks projected to outperform within each industry. Regular client meetings can provide ongoing counsel and feedback to help manage behavioral tendencies.

On the plus side, Cautious Delegators are unlikely to have “outlier” investment results compared to their peers. On the down side, it can be difficult for the index-constrained style to deliver sustained outperformance sufficient to outweigh the costs of active management. For the Cautious Delegator, the measure of an advisor’s value will relate in large part to the way the advisor helps avoid actual losses from market timing and opportunity losses from missing market exposure.

Doomers are undecided about market efficiency, and don’t restrain their behavioral tendencies. In this way, they’re the “even more worried” cousins of the Fearful Rationalists, and the “manic” cousins of the Risk Hedgers.

Doomers have good risk management instincts, but don’t discipline those instincts successfully. As a result, their biggest investment risk often tends not to be the macro-economic or “bubble popping” events they most fear, but rather themselves – and their self-imposed opportunity losses from missing market exposure.

To manage themselves, like Fearful Rationalists, Doomers should work with an advisor, one who will keep them focused on the matching of particular investments to particular financial goals, and who takes the time to listen to them very carefully and build trust. In many instances, this type of advisor will be a “wrap” fee financial planner.

Omaha Oracles are the types of investors many aspire to be, but few become. Buffet, Klarman, and an elite few others show the incredible value of this Investment Personality when it is matched with skill in security selection.

Omaha Oracles believe markets are not efficient and manage their own behavioral tendencies very effectively. They enjoy security selection and tend not to worry very much about macro-level factors. Often, they don’t want to work with advisors, but if their interests lie elsewhere than investing, they might carefully pick an active investment manager or fund sharing their philosophy.

When a person thinks he or she is an Omaha Oracle, but they’re not, the mismatch between goals and aspiration can be quite damaging. Further, for long periods of time the Omaha Oracle’s positions may be out of favor, and during those periods of time it’s important to have sufficient liquidity to meet lifestyle expenses without selling.

Day Traders don’t believe markets are efficient, but at least are honest with themselves that they don’t manage their own behavioral tendencies all the time. They won’t be happy with a passive or constrained active investment strategy, and enjoy more frequent trading. A wrap fee broker can be a good advisory fit. In contrast, a commission-based broker will likely play to the Day Trader’s behavioral tendencies; over time this might be lucrative for the broker, but not so for the Day Trader.

At best, if Day Traders are smart and/or lucky enough to make consistently profitable trades, or choose a very talented broker, they have the opportunity to obtain above-average performance. The down side compared to other investor personalities is higher costs, and the life cycle financial planning consequences of large trades or concentrated positions that go bad. In my experience, Day Traders are more vulnerable to unscrupulous advisors than many other investment personality types.

CNBC Targets don’t believe in market efficiency, nor do they manage their own behavioral tendencies. As a CNBC Target, one is vulnerable to both high investment costs (including trading costs and taxes) and poor market timing. Working with an ethical wrap-fee broker can be a way to mitigate these risks. As with Day Traders, in my experience, CNBC Targets have heightened vulnerability to unscrupulous advisors.

Clients with the self-awareness to honestly assess your own Investor Personality will find it easier to make consistent and effective investment decisions in the context of their overall financial and estate planning. Similarly, advisors who recognize and accommodate the various Investor Personalities of their clients will have less friction, more fun, and provide better service and results.

KYEstates does not provide investment advice and does not recommend the purchase or sale of any security. A detailed disclaimer is available here.